With 5.81% CAGR, Freighter Aircraft Market Size to Hit USD 6.18 Billion by 2032

Key companies covered in the freighter aircraft market are Airbus SE, The Boeing Company, Bombardier Inc., Antonov, Lockheed Martin Corporation, and others.

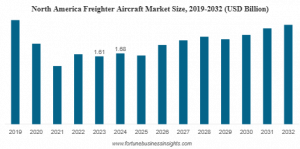

TX, UNITED STATES, May 14, 2025 /EINPresswire.com/ -- The global freighter aircraft market size was valued at USD 4.25 billion in 2024. The market is projected to grow from USD 4.16 billion in 2025 to USD 6.18 billion by 2032, registering a CAGR of 5.81% during the forecast period 2025-2032.Freighter aircraft, both newly manufactured and converted from passenger configurations, play a pivotal role in global logistics and air cargo delivery. Their increased deployment in e-commerce, express shipping, and global trade has propelled market expansion. Growing investments by air cargo operators, along with a surge in demand for fast and reliable shipping solutions, are driving growth in the coming years.

Fortune Business Insights™ presents this data in its latest study titled “Freighter Aircraft Market Size, Share, Forecast, and 2025–2032.”

Get a Free Sample Research Report:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/freighter-aircraft-market-108393

List of Key Players Profiled in the Report:

Airbus SE (Netherlands)

The Boeing Company (U.S.)

Embraer S.A. (Brazil)

Bombardier Inc. (Canada)

Textron Aviation Inc. (U.S.)

Antonov (Ukraine)

Lockheed Martin Corporation (U.S.)

Ilyushin Aviation Complex (Russia)

ST Engineering Inc. (Singapore)

ATR Aircraft (France)

Get a Quote Now:

https://www.fortunebusinessinsights.com/enquiry/get-a-quote/freighter-aircraft-market-108393

Market Drivers and Restraints

Growing E-Commerce Trade and Expanding Global Trade Drive Market Growth

The explosive growth in global e-commerce, with rising demand for next-day and same-day deliveries, has significantly increased reliance on air cargo services. Freighter aircraft are becoming central to this shift, ensuring quick, long-distance deliveries across continents.

According to Boeing’s 2024 air cargo forecast, e-commerce is expected to account for nearly 25% of the global air cargo business by 2043, driven by a 5.8% annual growth rate in express shipments. In comparison, general cargo is projected to grow at a slower 3.6% CAGR.

Routes between China, Europe, and the U.S. have seen particularly high growth, prompting a spike in demand for long-range, high-capacity aircraft like the Boeing 777F and Airbus A350F.

Restraint – High Operating and Maintenance Costs

Despite promising growth, the high acquisition, fuel, and maintenance costs associated with freighter aircraft, especially wide-body types, may hinder adoption, particularly for smaller logistics operators.

Market Segmentation

By Freighter Type

OEM Configured

P2F (Passenger-to-Freighter) Converted

By Engine

Turboprop

Turbofan

By Aircraft Type

Narrow Body

Wide Body

Regional Aircraft

Others

By Application

Commercial

Military

Regional Insights

North America to Lead the Global Market Backed by Advanced Logistics Infrastructure

North America is set to dominate the freighter aircraft market throughout the forecast period. The region's extensive e-commerce operations, led by players such as Amazon and FedEx, have driven significant fleet expansion and upgrades.In December 2024, Amazon extended its logistics services across India to support both B2B and B2C deliveries, showcasing the globalization of its air cargo footprint.

Asia Pacific to Witness Fastest Growth Amid Booming Trade Corridors

The Asia Pacific region is expected to grow at the fastest pace, driven by increased demand for air cargo services between Southeast Asia, China, and Western markets. Investment in freighter conversions and expanding logistics networks are accelerating regional market expansion.

Ask for Customization:

https://www.fortunebusinessinsights.com/enquiry/ask-for-customization/freighter-aircraft-market-108393

Competitive Landscape

Industry Players Focus on Partnerships and Conversions to Strengthen Market Position

Market participants are increasingly investing in P2F conversions and collaborating with global MROs to enhance aircraft availability and reduce lead times. Strategic partnerships and new service centers in emerging markets are key growth levers.

Report Coverage

The report offers a comprehensive assessment of the freighter aircraft market, analyzing growth drivers, trends, and competitive dynamics. It segments the market based on aircraft type, configuration, engine type, application, and geography. Additionally, it highlights recent technological developments and key strategic initiatives.

Key Industry Developments:

December 2024 – Global Crossing Airlines (U.S.) partnered with a private equity group to expand operations in Australia, launching a new cargo and passenger transport division.

November 2024 – Elbe Flugzeugwerke GmbH (EFW) and MRO Japan (MJP) partnered for Airbus narrow-body P2F conversions, establishing Japan’s first dedicated transformation site.

Read Related Insights:

Hydrogen Aircraft Market Size, Share, 2032

Airport Retail Market Share, Size, Trends, 2032

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

email us here

Visit us on social media:

LinkedIn

Facebook

X

Distribution channels: Aviation & Aerospace Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release